CRM for insurance brokers is a game-changer in the insurance industry, offering a comprehensive solution to manage leads, automate processes, and enhance customer relationships. By leveraging the power of CRM, insurance brokers can gain a competitive edge and drive business growth.

With its robust features and seamless integration capabilities, CRM empowers insurance brokers to streamline their operations, improve efficiency, and deliver exceptional customer experiences. Embracing CRM technology is a strategic move that can transform the way insurance brokers operate and succeed in today’s competitive market.

CRM Overview for Insurance Brokers

Customer relationship management (CRM) systems are essential tools for insurance brokers to manage their client relationships, streamline sales processes, and grow their businesses. CRM systems provide a centralized platform for brokers to track all their client interactions, from initial contact to policy renewal.

Lead Management

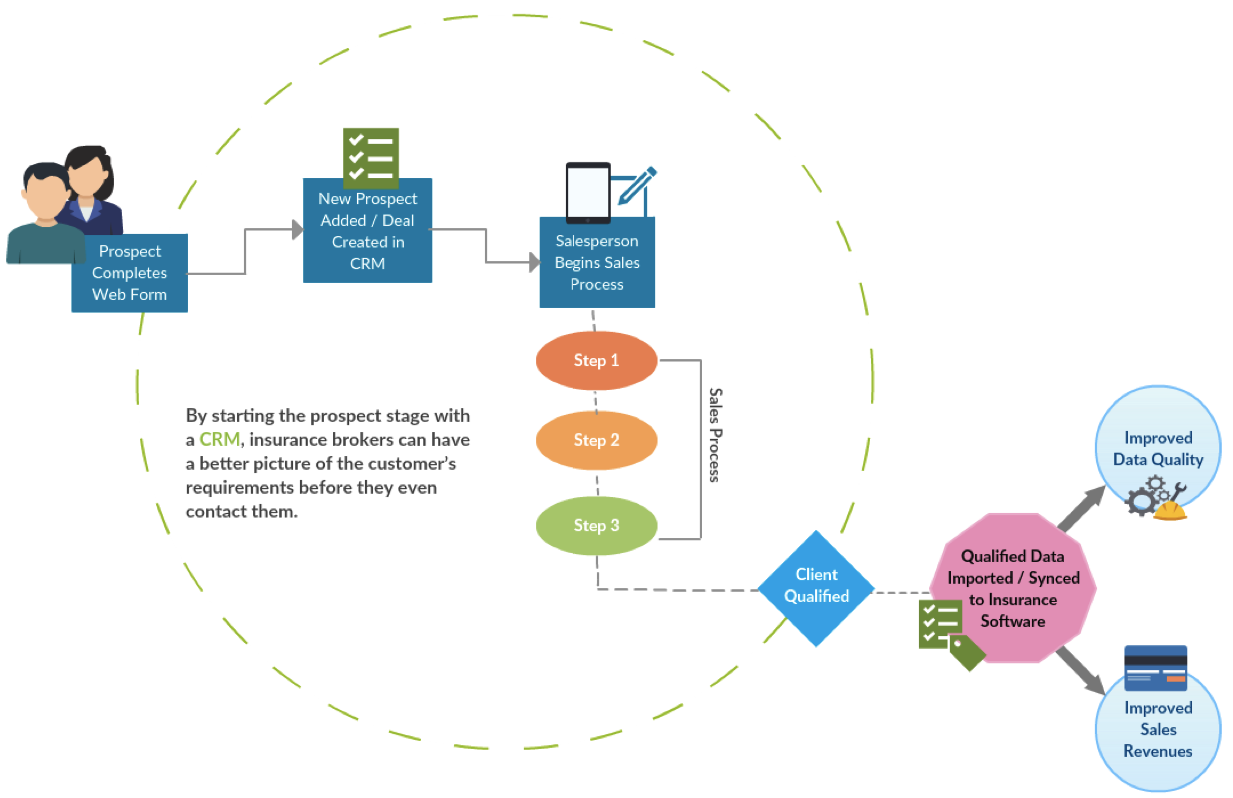

One of the key benefits of CRM systems for insurance brokers is their ability to streamline lead management. CRM systems can help brokers capture and qualify leads, track their progress through the sales pipeline, and nurture them until they are ready to purchase.

- Capture leads from multiple sources, such as websites, email marketing, and social media.

- Qualify leads to identify those who are most likely to become customers.

- Track lead progress through the sales pipeline.

- Nurture leads with automated marketing campaigns.

Sales Process Automation

CRM systems can also help insurance brokers automate their sales processes. This can free up brokers to focus on more strategic tasks, such as building relationships with clients and developing new business.

- Automate tasks such as sending emails, scheduling appointments, and creating quotes.

- Track sales performance and identify areas for improvement.

- Generate reports to gain insights into sales trends and customer behavior.

Features of a CRM for Insurance Brokers

An effective CRM system for insurance brokers streamlines operations, enhances customer relationships, and drives business growth. When selecting a CRM, it’s crucial to consider the following essential features:

These features empower insurance brokers to manage their client base efficiently, track interactions, automate processes, and gain valuable insights into their business.

Contact Management

- Centralized storage of client data, including contact information, policies, and communication history

- Automated lead capture and lead management tools

- Segmentation and filtering capabilities to target specific client groups

Policy Management

- Tracking of policy details, coverage, premiums, and expiration dates

- Automated policy renewal reminders and notifications

- Integration with underwriting systems for seamless policy issuance

Sales Pipeline Management

- Visualization of the sales pipeline and tracking of opportunities

- Automated workflow for lead qualification and follow-up

- Reporting and analytics to identify bottlenecks and improve conversion rates

Marketing Automation

- Automated email marketing campaigns and personalized communications

- Lead nurturing sequences to engage potential clients

- Tracking of campaign performance and ROI

Customer Relationship Management, Crm for insurance broker

- 360-degree view of customer interactions across all channels

- Personalized communication and relationship building

- Customer segmentation and targeted marketing campaigns

Reporting and Analytics

- Customizable reports and dashboards for key performance indicators

- Analysis of sales performance, customer acquisition, and retention

- Data-driven insights to make informed decisions

Specific CRM Tools for the Insurance Industry

Several CRM systems are specifically designed to meet the unique needs of insurance brokers. These include:

- AgencyBloc

- Insureio

- ProducerPro

- MyAgencyPlatform

- Applied Epic

These CRM tools offer tailored features, such as integration with insurance carrier systems, policy management modules, and industry-specific reporting capabilities.

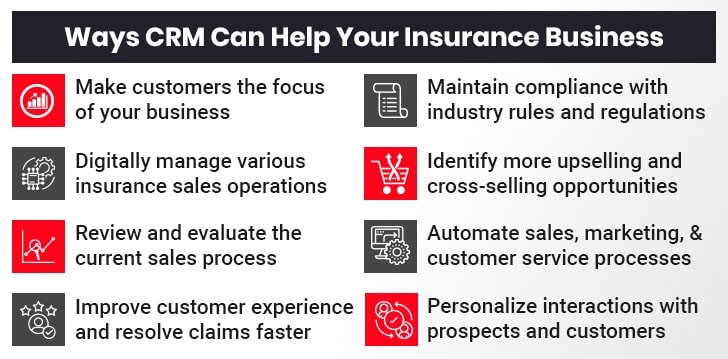

Benefits of Using a CRM for Insurance Brokers

CRM systems provide numerous advantages for insurance brokers, enhancing their efficiency, productivity, and customer service capabilities. By centralizing client data, streamlining processes, and automating tasks, CRMs empower brokers to manage their operations effectively and deliver exceptional experiences to their clients.

Numerous case studies and success stories attest to the transformative impact of CRMs on insurance brokerages. For instance, a leading insurance brokerage reported a 20% increase in sales conversion rates and a 30% reduction in administrative costs after implementing a CRM system.

Improved Client Management

- Centralized client data provides a comprehensive view of client interactions, preferences, and policies.

- Automated reminders and follow-ups ensure timely communication and proactive client engagement.

- Personalized interactions foster stronger relationships and increase client satisfaction.

Enhanced Sales Productivity

- CRM systems track leads, manage pipelines, and provide insights into sales performance.

- Automated workflows streamline the sales process, reducing time spent on administrative tasks.

- Data-driven insights help brokers identify opportunities, prioritize prospects, and optimize sales strategies.

Streamlined Operations

- Centralized communication channels eliminate the need for multiple platforms, reducing administrative burden.

- Automated tasks, such as policy renewals and document management, free up time for brokers to focus on client relationships.

- Integrated reporting provides real-time visibility into key metrics, enabling brokers to make informed decisions.

Improved Customer Service

- CRMs provide a comprehensive history of client interactions, enabling brokers to respond quickly and effectively to inquiries.

- Automated self-service portals empower clients to access policy information and make changes conveniently.

- Personalized communication channels ensure that clients receive timely and relevant updates.

CRM Integration with Other Systems

Integrating your CRM with other business systems is crucial for streamlining operations and enhancing efficiency. By connecting your CRM to other applications, you can automate data exchange, reduce manual data entry, and maintain data consistency across all systems.

CRM integration with other systems offers numerous benefits:

Data Accuracy and Consistency

When your CRM is integrated with other systems, data is automatically updated and synchronized across all connected applications. This eliminates the risk of manual errors and ensures that all teams have access to the most up-to-date information. For example, if a policyholder’s address changes in your CRM, the change will automatically be reflected in your accounting system and other relevant applications.

Improved Efficiency

Integration automates data exchange between systems, reducing manual data entry and freeing up your team to focus on more value-added tasks. For instance, when a new lead is captured in your CRM, it can automatically trigger the creation of a sales opportunity in your project management system.

Enhanced Collaboration

Integration fosters collaboration by providing all stakeholders with a single source of truth. By connecting your CRM to other systems, such as email marketing or collaboration tools, you can share customer information and track interactions across different departments, ensuring everyone has a comprehensive view of the customer relationship.

Streamlined Processes

Integration streamlines business processes by eliminating manual handoffs and data duplication. For example, when a policy is issued in your CRM, the system can automatically generate an invoice in your accounting system and send a notification to the customer.

Challenges of Implementing a CRM

Implementing a CRM system can bring numerous benefits to insurance brokers, but it also comes with its share of challenges. These challenges can range from technical issues to resistance from employees.

Technical Challenges

One of the most common challenges is ensuring that the CRM system is compatible with the broker’s existing systems. This can be a complex process, especially if the broker uses a variety of different software programs. Another technical challenge is ensuring that the CRM system is secure and meets all regulatory requirements.

Resistance from Employees

Another common challenge is resistance from employees. Employees may be resistant to change, or they may not understand the benefits of using a CRM system. It is important to communicate the benefits of the CRM system to employees and to provide training to help them learn how to use it effectively.

Overcoming the Challenges

There are a number of strategies that insurance brokers can use to overcome the challenges of implementing a CRM system. These strategies include:

- Partnering with a vendor that has experience in implementing CRM systems for insurance brokers.

- Creating a project plan and timeline for the implementation process.

- Communicating the benefits of the CRM system to employees and providing training to help them learn how to use it effectively.

- Testing the CRM system thoroughly before going live.

- Monitoring the CRM system’s performance and making adjustments as needed.

By following these strategies, insurance brokers can increase the chances of successfully implementing a CRM system and reaping the benefits that it can offer.

Best Practices for Using a CRM

To maximize the effectiveness of a CRM system for insurance brokers, it is essential to adopt best practices that optimize its functionality and streamline operations.

A structured approach to CRM implementation and utilization ensures that the system aligns with the specific needs of insurance brokers and delivers tangible benefits.

Key Steps for Effective CRM Usage

| Step | Description |

|---|---|

| 1 | Define Clear Goals and Objectives: Establish specific and measurable goals for CRM implementation, such as improving customer retention or increasing sales conversion rates. |

| 2 | Choose the Right CRM Solution: Evaluate different CRM systems based on their features, functionality, and alignment with the broker’s specific requirements and budget. |

| 3 | Data Import and Cleaning: Import existing customer and prospect data into the CRM and ensure its accuracy and completeness to facilitate effective data management. |

| 4 | Process Automation: Leverage the CRM’s automation capabilities to streamline repetitive tasks, such as email follow-ups, appointment scheduling, and lead generation. |

| 5 | Regular Monitoring and Evaluation: Track key performance indicators (KPIs) to assess the effectiveness of the CRM system and make adjustments as needed to optimize its performance. |

| 6 | Ongoing Training and Support: Provide training and support to users to ensure they are proficient in using the CRM system and can leverage its full potential. |

Emerging Trends in CRM for Insurance Brokers

The insurance industry is undergoing a digital transformation, and customer relationship management (CRM) systems are at the forefront of this change. CRM systems can help insurance brokers manage their relationships with customers, track leads, and close deals. As technology continues to evolve, new trends are emerging in CRM that are relevant to insurance brokers.

These trends can enhance the customer experience and drive business growth.

Artificial Intelligence (AI)

AI is rapidly changing the way that businesses operate, and the insurance industry is no exception. AI can be used to automate tasks, improve customer service, and identify new opportunities. For example, AI-powered chatbots can be used to answer customer questions and schedule appointments.

AI can also be used to analyze data and identify patterns that can help insurance brokers target their marketing efforts.

Cloud Computing

Cloud computing is another major trend that is impacting the insurance industry. Cloud-based CRM systems are more flexible and scalable than on-premise systems, and they can be accessed from anywhere with an internet connection. This makes it easier for insurance brokers to work from home or on the go.

Cloud-based CRM systems also offer a number of other benefits, such as:* Reduced IT costs

- Increased data security

- Improved collaboration

Mobility

The increasing popularity of mobile devices is another trend that is impacting the insurance industry. Mobile CRM systems allow insurance brokers to access their data and manage their relationships with customers from anywhere. This can help insurance brokers to be more productive and efficient.

Mobile CRM systems also offer a number of other benefits, such as:* Improved customer service

- Increased sales opportunities

- Reduced travel costs

Integration with Other Systems

CRM systems can be integrated with other systems, such as accounting systems, marketing automation systems, and document management systems. This integration can help insurance brokers to streamline their workflows and improve their efficiency. For example, a CRM system can be integrated with an accounting system to automatically generate invoices and track payments.

A CRM system can also be integrated with a marketing automation system to automate email campaigns and track lead generation.

Data Analytics

Data analytics is another important trend that is impacting the insurance industry. CRM systems can be used to collect and analyze data about customers, leads, and sales. This data can be used to identify trends, improve customer service, and make better decisions.

For example, a CRM system can be used to track customer interactions and identify patterns that can help insurance brokers to improve their sales pitch.These are just a few of the emerging trends in CRM for insurance brokers. As technology continues to evolve, new trends will emerge that will help insurance brokers to better manage their relationships with customers, track leads, and close deals.

By staying up-to-date on the latest trends, insurance brokers can gain a competitive advantage and drive business growth.

Concluding Remarks

In conclusion, CRM for insurance brokers is an indispensable tool that can revolutionize business operations and customer engagement. By implementing a CRM system, insurance brokers can unlock a world of benefits, including streamlined lead management, automated sales processes, enhanced data accuracy, and improved customer satisfaction.

Embracing CRM technology is a wise investment that will pay dividends for years to come.

Answers to Common Questions

What are the key benefits of CRM for insurance brokers?

CRM systems offer numerous benefits for insurance brokers, including streamlined lead management, automated sales processes, improved data accuracy, enhanced customer engagement, and increased revenue generation.

How can CRM help insurance brokers streamline lead management?

CRM systems provide centralized lead management capabilities, allowing brokers to capture, qualify, and track leads effectively. They automate lead nurturing processes, ensuring that every lead receives personalized attention and timely follow-ups.

What are some essential features to look for in a CRM for insurance brokers?

When choosing a CRM for insurance brokers, it’s crucial to consider features such as lead management, sales automation, policy management, commission tracking, and customer relationship management.